How to Open a Wema Domiciliary (DOM) Account without Visiting the Bank

Do you want to open a DOM account in Nigeria without having to visit the bank or provide a guarantor? With the Wema DOM Lite Account, you can receive as much money as you want without having to deposit any dollars. Here's how you can create a Wema DOM Lite Account in Nigeria.

Requirements to Open a Wema DOM Lite Account

To create a Wema DOM Lite Account, you will need to provide some personal information including:

- Bank Verification Number (BVN)

- A filled account opening form (online via the AlatByWema app)

- A valid ID Card (Driver's License, International Passport, National Identity Card, or Voter's Card)

- A smartphone to install the AlatByWema app

- A selfie and video of yourself.

Benefits of Wema DOM Lite Account

- Convenient channel for receiving international remittances on a regular basis.

- Safe and simple way to store and save money in foreign currency.

- No limits on the amount of money that can be transferred inward.

Features of Wema DOM Lite Account (Alat By Wema)

- No minimum opening or operational balance.

- Maximum cash withdrawal amount of $2,000 with a withdrawal fee of 0.05% of transaction value, up to $10 per transaction.

- No cash deposits are permitted.

- Access to a USD Mastercard Debit Card for online dollar payments/subscriptions and withdrawals from ATMs worldwide.

- Upgrade to Wema Domiciliary Plus with the submission of full KYC documentation.

- Ability to form foreign currency investments via a fixed deposit or USD Goals on the AlatByWema app.

- Foreign currency cash withdrawals and transfers available at all locations.

How to Create an AlatByWema Domiciliary Account

Step 1:

- Install the AlatByWema AppDownload the AlatByWema app from the Google Playstore.

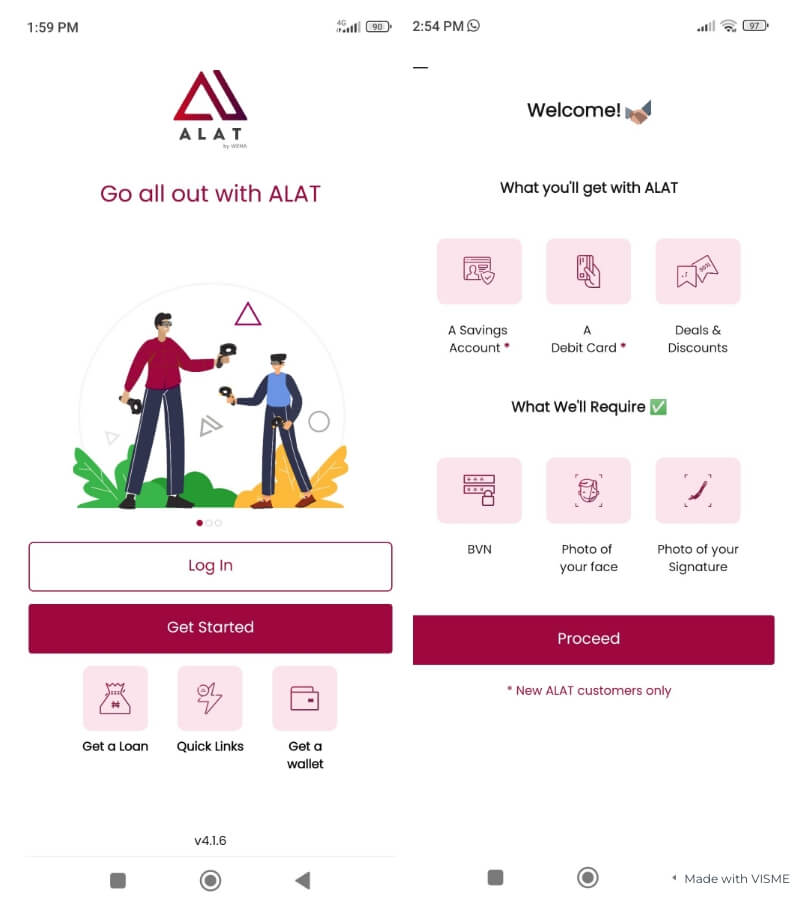

- Install the app and open it for the first time.

Step 2:

- Register for an AccountGrant the app necessary permissions.

- Click "Get Started" and proceed to the next page.

- Enter your country of residence, phone number, and email address.

- Enter your BVN, take a clear picture of your face and signature, and verify your identity.

- Enter your address information and upload a snapped copy of your ID card.

- Complete the registration process.

Step 3:

- Create a DOM AccountAutomatically, you will receive a Wema Naira account.

- Request a card and then upgrade to a Wema DOM Lite Account by following the instructions in the app.

In conclusion, with the Wema DOM Lite Account, you can enjoy a convenient, safe, and simple way to receive and store foreign currency without having to visit the bank. Simply follow the steps above to create your account today!

Comments

Post a Comment

Contribute or Ask a Question!